That means you can shop online or when you travel, in a broad range of 50+ foreign currencies, with no foreign transaction fee.

#Foreign transaction fee chase free

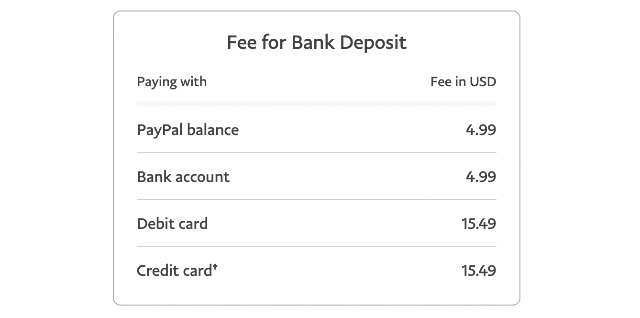

You’ll just pay a low, transparent conversion charge, and then it’s free to spend any currency you hold using your card. All currency conversion is done using the real mid-market rate with no markup and no hidden fees. You’ll then be able to top up your account with USD, and switch to the currency you need online or using the handy Wise app. Simply open a free online Wise multi-currency account and get your linked debit card. It’s good to know that you can avoid foreign transaction fees entirely with Wise. Get your Wise debit card with zero foreign transaction fees USD5 for withdrawal USD2.50 for a transfer or inquiry ATM operator fees may also apply If you’re using your Chase card to make a withdrawal at an ATM overseas, you may need to pay an extra fee on top of the foreign transaction costs. Check your specific account terms and conditions for more. However, if you’re spending in a currency other than USD, in most cases you’ll pay the foreign transaction fee. You should be able to use your Chase debit card anywhere you see the card network accepted. While the network rate is usually pretty close to the mid-market rate, the foreign transaction fee can be quite significant - 3% in the case of Chase.

They’ll then normally add a foreign transaction charge, in the form of a percentage markup. They’ll start with the live exchange rate used by the network that issued your debit card (Visa or Mastercard, for example). That’s because of the way banks calculate the amount you’ll ultimately pay. However, this is seldom the rate you’ll get when your international card purchase is converted back into USD.

The mid-market rate is the one you’ll find on Google - the one set by the currency markets, and used by banks when they buy and sell large orders of foreign currency. To understand the costs you’ll pay when using your Chase debit card overseas, it helps to know a little about the mid-market exchange rate. Chase debit card foreign transaction exchange rates Always opt to pay in the local currency where you are to get the best available deal. It sounds like a simple way to immediately see the costs of your transaction - but it can actually mean you get a far worse exchange rate and higher costs than you would if you allowed Chase and your card network to process the payment. This is where you’re asked if you want to pay using your home currency (USD) instead of the local currency wherever in the world you are. It’s also good to know that using your debit card abroad can mean you run into extra costs if you get caught out by dynamic currency conversion - DCC. If they don’t do this, it’s down to you to inform Chase to get your money back. These should be quickly reimbursed, but this relies on the merchant or ATM network informing Chase about the fee in the first place. Additional Chase debit card feesĮven if you have a Chase account which waives foreign transaction fees, Chase notes that some fees may be applied to your account for services like ATM withdrawals.

#Foreign transaction fee chase full

Check out the full terms and conditions online to learn more. However, to access these accounts without paying the fees, you’ll need to hold a significant deposit in Chase of USD75,000 - USD150,000 or fulfil a broad range of eligibility criteria. The Chase Foreign Exchange Rate Adjustment Fee is waived for some Chase premium accounts, such as Private Client accounts and the Sapphire Checking account. We’ll cover these a little later in more detail. This may be in addition to other Chase charges, or costs levied by the merchant or ATM network. This charge means you’ll pay an extra 3% fee for any purchases and withdrawals made abroad, or online purchases which are made in a foreign currency. One key charge to know about is the Chase debit card foreign transaction fee, also called the foreign exchange rate adjustment fee: Foreign transaction typeĬhase Foreign Exchange Rate Adjustment Feeĭebit card purchase made in a currency other than USDĪTM or counter withdrawal made in a currency other than USDģ% Additional ATM fees may also apply - more on that later However, if you’re using your card abroad you’ll need to know about the extra costs you may face. Get your multi-currency card Chase debit cards international transaction feeĬhase debit cards can be used to make purchases and withdrawals all over the world.

0 kommentar(er)

0 kommentar(er)